This chapter is co-authored with David Burch, Senior Researcher at CLES.

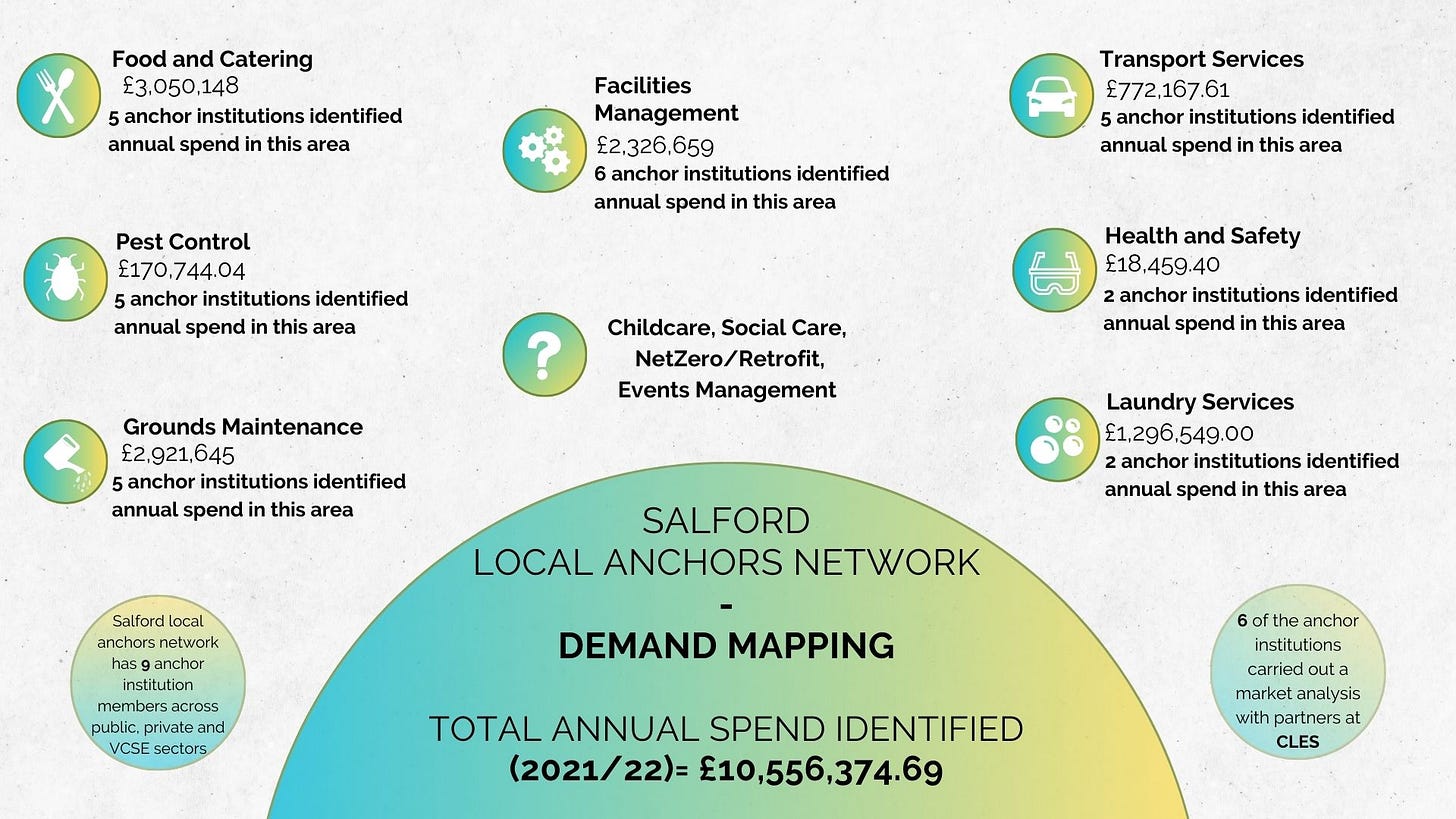

In this chapter, we talk about our market analysis, how we identified £10 million of recurrent annual expenditure that could be redirected locally, and started to create real market opportunities for new social enterprises and what we learned from this process.

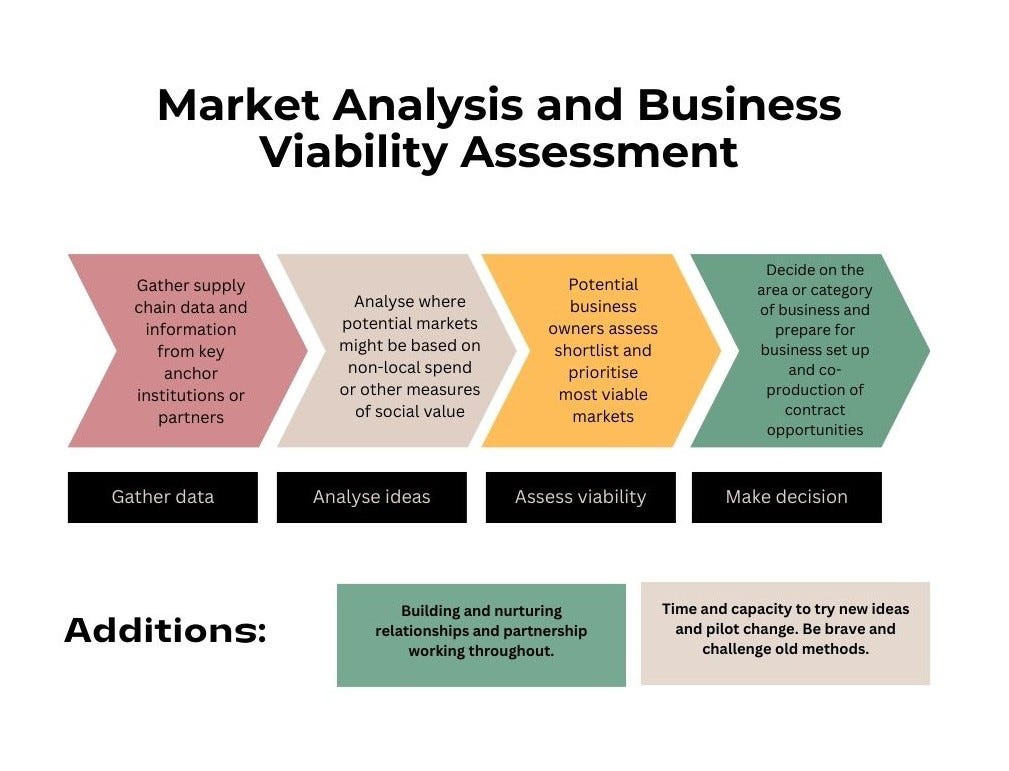

Our community wealth building approach currently focuses on the principle of progressive procurement and grassroots responses to shifting wealth and ownership. We set out to identify viable and realistic market opportunities within the local anchor institutions’ supply chains that would be suitable for local people to provide goods, works or services in the form of social/co-operative enterprise. We worked with the Centre for Local Economic Strategies (CLES) to complete a market analysis.

Local sourcing of suppliers is an important step in increasing wealth in an area. It has benefits to local communities and the organisations themselves. Organisationally, selecting local suppliers can provide benefits such as greater control over services provided, reduced environmental impact and often increased flexibility and better relationships with the supplier. Sourcing local suppliers can strengthen the local economy and local anchor institutions can have a huge positive impact in this way due to their annual expenditure.

Our approach to the market analysis at this stage of the project was to analyse a period of existing, recurrent annual expenditure in six local anchor institutions across the public and VCSE sectors. In total, approximately £498 million was analysed during this exercise. The spend was then split by geographical location of supplier to determine the local percentage and ‘leakage’. In this instance, leakage refers to expenditure outside of Greater Manchester and, in some cases, outside Salford.

Seven categories of spend were chosen from the analysis. The rationale in selecting these sectors was that there was a realistic chance of delivery by start-up social/co-operative businesses. For example, they were:

• significant spend outside of Greater Manchester (as a percentage of total spend with the organisation in that category);

• not part of a long-term contract already let and/or which local anchor institutions have no discretion over (such as contracts under the Private Finance Initiative);

• not prohibitive for a local start-up organisation to be able to deliver (such as by contract value), capital investment (such as machinery) or specialist technical skills).

In addition, discussions with local anchor institutions revealed other needs, challenges and market opportunities, as reflected in the diagram above. We explored whether or not a new social/co-operative enterprise could provide a solution to these, or an alternative to an existing supplier that did not meet requirements. Examples of these market opportunities included: event management; net zero work and retrofitting; and onsite childcare for staff.

Implications for local economy

Through this market analysis exercise, we identified £10 million of existing spend that could be shifted to local suppliers and social/co-operative businesses. This would give local people the opportunity to enter supply chains as providers of goods, works and services.

A progressive approach towards procurement and employment offers many benefits to the local economy. In our analysis, we used the Local Multiplier 3 (LM3) tool developed by the New Economics Foundation. This provides an understanding of any local economic impact an organisation can have. For example, the implications for the local economy in Salford if the expenditure described above was redistributed locally could include:

· Increased local spend, meaning more money staying in Salford and being spent in the local economy. This could add as much as £7.2 million per year to the local economy.

· Increased economy activity as localised spending would support additional jobs. We estimated this to be 248 additional jobs supported per year for the additional local spend in Salford by local anchor institutions.

· Increased expenditure by the new employees created by the investment into the local economy. This is dependent on the place and organisation, but applying a prior survey in Greater Manchester to this employment forecast suggests an estimated additional £4.1 million per year.

Market viability assessment with local people

Once we had gathered and analysed the initial information from the local anchor institutions, the group of local people did their own viability assessment on each of the markets. Their purpose was to identify which markets to shortlist and prioritise for potential business ventures. The underlying drive was to create socially driven and collectively owned businesses. The group members had previously spent time learning about different models of business, exploring social issues that were meaningful to them and developing relationships with one another.

This list of questions, developed by the group, details essential aspects of this viability assessment process. The local anchor institutions provided answers to the questions for all seven categories.

1. What services, goods or works are provided under this category?

2. How many suppliers in total provide these services under this category?

3. What is the value of each of these services?

4. What is the current contract length for each of these services/suppliers?

5. Are any of these services deemed to be temporary or not required long term?

6. Are there any contracts or services in this category that could be broken down to provide small and medium enterprises (SMEs) with a chance to acquire a small contract?

As well as this information, the group also analysed their own strengths, experience, interests and ambitions in order to decide their best fit for each business opportunity.

The group was guided through different exercises in self-development to determine which opportunities to prioritise and who best matched each one. Examples of these were based on ideas such as red and blue ocean strategy, ranking businesses on their assessment of what makes them a ‘good business’ or ‘good employer’, creating ideas of businesses with a social purpose, and others.

If you are interested in any of these exercises or want to know more on this stage, please get in touch.

At the end of this process, the group ranked the options in order of viability. The two opportunities the group prioritised were: food and catering; and pest control.

Reflections on the market analysis

The market analysis is an essential step in gaining a better understanding of local procurement and of the potential impact that local anchor institutions could have using their expenditure and supply chains.

Working with CLES on this analysis was extremely useful due to their knowledge and experience of community wealth building and of measuring local economic impact of progressive procurement in other places. We recommend looking at CLES’ work to learn more.

The entire process described above took around 18 months in total. It was important to work through every stage comprehensively and at the right pace for everyone involved. Most of the local anchor institutions and local people were new to community wealth building and needed time and knowledge building to understand why and how they would be involved.

Another aspect was the time spent building relationships and rapport that is essential for comfortable information sharing and meeting suitable timelines. Although this process could be completed more quickly, depending on existing knowledge and relationships, we recommend ensuring that all parties understand their role, the overall purpose of the exercise and what information is required to reduce the back and forth between parties where not wholly necessary.

We worked closely with procurement professionals at each of the local anchor institutions. This enabled us to gather all of the required information and additional detail in order for the group to make decisions on potential business opportunities. The procurement professionals were instrumental due to their knowledge and experience of procuring goods, works and services and associated regulations.

We also found it useful to identify and work closely with a member of each local anchor institution who had decision-making capacity. This helped us to overcome any barriers, such as information sharing or timescales, and aided our understanding of which opportunities could assist each organisation with any challenges they were facing.

Feedback from the procurement and other professionals involved in this process was positive. Some reflected that they enjoyed learning how their role could create greater social value, connect to the wider community and have a positive impact on Salford.

In future, we want to include a wider range of market categories, as many in this first round involved manual labour-related work. Local people have different ranges of interests, skills and physical abilities, and therefore could be suited to opportunities such as those in digital or creative which were limited in this initial analysis.

We enjoy sharing our journey and the steps we are taking towards an inclusive economy here in Salford. Please reach out to us on ehlsalford@unlimitedpotential.org.uk if you have any questions or want to do something similar and think we might be able to help.

Next time:

How are local people starting to create new social businesses that can enter the supply chains of local anchor institutions?

Please share your comments, answers and questions with us below. If you have a newsletter and would like to feature us, please get in touch.

Next chapter here:

Economics with People

This chapter is co-authored by Lewis Nelson, Economies for Healthier Lives Co-production Facilitator, with Jasmine Graham and Josh Baxter, two local people involved in the co-production work and in the process of setting up social enterprises.